Recreational & Medical Marijuana in Illinois

Visit a Verilife dispensary in Illinois for all your cannabis needs. Browse our medical and recreational menus to find your favorite products.

Recreational & Medical Marijuana in Illinois

'Tis the Season to Save on Your Stash!

Unwrap big savings this holiday season at our Verilife dispensaries in Illinois!

Recreational Cannabis in Illinois

Choose your recreational dispensary menu to begin shopping.

Medical Menus in Illinois

Have a medical marijuana card? Check out our medical menus.

Dispensary Deals & Specials in Illinois

Check out the deals and discounts at each of our Illinois dispensaries to find the best offers.

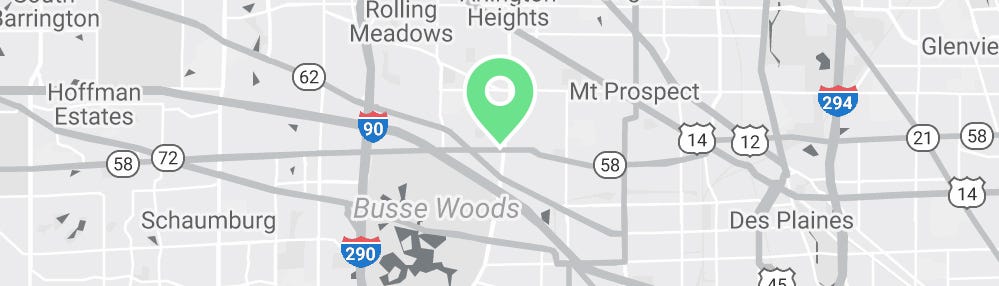

Find a Dispensary in Illinois

Visit one of our Illinois dispensaries for all of your cannabis shopping needs.

Check out our blog to learn about all things cannabis!

DIY THC Bath Bomb Recipe

What’s more relaxing than a hot bath at the end of a stressful day? A hot bath with a THC bath bomb.

Cannabis & Valentine's Day

Roses aren't the only flower taking center state on Valentine's Day! Learn more about including the plant into your holiday.

Strain Spotlight: Wedding Cake

Imagine making a strain that smells so good you know it needs a special name...like Wedding Cake.

Price Match Guarantee

Find a better price at another local dispensary? We’ll match it with our Price Match Guarantee.

*Please note that orders must be picked up during the promotional period to receive reduced pricing. Offers cannot be combined. Subject to the regulatory eligibility.

Join VeriVIP to earn rewards and be the first to hear about the latest deals at our dispensaries.

Dispensaries in Illinois

Learn more about buying cannabis in Illinois, including where you can purchase and how much.

Illinois Medical Card

Check out our guide to getting a medical cannabis card, including application steps.

Frequently Asked Questions

Here are some of the most common questions we get at our Illinois dispensaries. Our Verilife budtenders are also available at each of our dispensaries to answer your questions.

Is cannabis legal in Illinois?

llinois legalized the sale of medical cannabis in 2013, under the Compassionate Use of Medical Cannabis Pilot Program Act, now called the Compassionate Use of Medical Cannabis Program Act. Adult-use cannabis sales were legalized in Illinois on January 1, 2020 for anyone 21+ years of age. This means you can purchase cannabis products like flower, edibles, concentrates, beverages, and more from state-licensed dispensaries.

Is marijuana legal in Chicago?

Yes, recreational and medical marijuana are legal in the entire state of Illinois. In fact, we welcome shoppers to our dispensary in Chicago's River North neighborhood.

What do I need to bring with me when visiting dispensaries in Illinois?

All dispensaries in Illinois require you to bring a state-issued ID in order to purchase marijuana products. For medical use, you also need to bring your Illinois-issued medical marijuana card, in addition to your state-issued ID.

Where can I consume marijuana products in Illinois?

You can use marijuana products in private (non-public) spaces. For example, you may consume cannabis in your home but not in a public park. Check out our guide to cannabis in Illinois for more information.

How can I apply for a medical marijuana card in Illinois?

Explore all there is to know with our guide to medical cannabis in Illinois.

What types of products do Verilife dispensaries sell in Illinois?

You can find a range of cannabis products at the Verilife dispensaries in Illinois. Some of the marijuana products Verilife carries include: edibles, vapes, flowers, pre-rolls, tinctures, topicals, gear, and concentrates.

Do you have a rewards program in Illinois?

If you frequent marijuana dispensaries in Illinois, or just want access to special offers on marijuana products, join VeriVIP. Our rewards program gives you points every time you purchase a product from a Verilife store.